Unfettered by the shackles of banks and governments, cryptocurrency can be freely traded by anyone—that includes you!—with balances recorded on a public ledger that you have open, transparent access to. In this article, we will walk you through what Bitcoin is, starting from its history to the wallets and exchange platforms you can use to buy, sell, and store it.

Bitcoin History

It all began on August 18, 2008 with the registering of the bitcoin.org domain. On October 31, an anonymous man (or group) who went by the name of Satoshi Nakamoto released a paper titled Bitcoin: A Peer-to-Peer Electronic Cash System to a cryptography mailing list, detailing what Bitcoin is and how it works. It was not until January 3, 2009, that the Bitcoin network came into being. Nakamoto mined the genesis block of Bitcoin, or block number 0. On January 9, the first open-source Bitcoin client was released, and thus the trading of cryptocurrency began. Cryptocurrency did not start and end with Bitcoin, with hundreds of others created and released to this date. Together, these other cryptocurrencies are called altcoins, including ether (ETH), ripple (XRP), Bitcoin cash (BCH), and dogecoin (DOGE). Learn how to create cryptocurrency in this article.

Bitcoin Value and Price

As of the time of this writing (March 24, 2021), one Bitcoin is valued at $56,149.59 (figure sourced from Coindesk). As the graph above shows, Bitcoin has seen a sharp increase in value since its inception in 2018, comfortably hovering between $50,000 and $60,000. Even though this figure seems to bode well at first, Bitcoin has had a history of being highly volatile, subject to intense fluctuations in value. In the next section, we briefly explore why this is so.

Why Is Bitcoin So Volatile?

The simple answer to this question is because of speculation. Sure, you can use Bitcoins to purchase goods and services, but most of such transactions remain firmly investment-based. This means that most people treat Bitcoin as an investment—it is subject to the buy-sell cycle that is so typical of regular investments. While no one person can influence how Bitcoin fares, there are still things you can do as an individual to ensure that you aren’t negatively impacted—especially if the cryptocurrency’s value plummets. Simply keep up to date with the latest news released on Bitcoin, and this will help you make informed decisions on whether or not to buy, sell, or hold on to your stock.

Buying Bitcoin

Interested in getting into the heart of Bitcoin trading? Check out our quick-start guide on how to buy Bitcoin below:

Before You Get Started

As exciting as the prospect of getting into Bitcoin is, it’s ill-advised to jump straight in. Before you begin your Bitcoin journey, make sure that you have these things in order: a digital wallet, a cryptocurrency exchange account, personal ID documents, a safe Internet connection, and a payment mode. This goes without saying, but even though there are no physical Bitcoins, don’t brag if you are able to afford large quantities of this cryptocurrency. While your Bitcoin reserves are tightly locked under your personal private key, criminals who are made aware of large holdings may try to hack and steal your key.

Bitcoin Wallet

Just like how you carry a physical wallet to store your cash and debit/credit cards, you’ll also need a wallet for Bitcoin. To this end, crypto wallets are available for you to download and use.

What are Crypto Wallets?

While we used the regular wallet as an analogy earlier, crypto wallets actually function very differently. Instead of storing your Bitcoins, crypto wallets act as a sort of organizer for your private key(s). To access your Bitcoins, you use both your private and public keys. There are two main types of crypto wallets: hot and cold. Hot wallets are wallets that are connected to the Internet via computers, phones, and other devices. Such wallets are the most susceptible to hacking, as they house the private keys that you use to access your Bitcoins. Cold wallets are, well, the opposite of hot wallets: these aren’t connected to the Internet. Because of this, they’re not as vulnerable as hot wallets and are much harder to compromise. Such wallets store your private key(s) on an offline device. This device also harbors software that lets you access your portfolio without exposing your private key(s). There’s even a special type of cold wallet known as paper wallets. Yep, you read that right. Paper. Basically, you hop onto a key generator site to create private keys and their QR codes, which you later print on paper. To maximize your security, turn off your Internet connection while the codes are generated before wiping your browsing history clean.

Best Crypto Wallet

Now that you know the value of crypto wallets, it’s time to hook you up with a dedicated one for all your Bitcoin investing needs. Here’s our guide to the best Bitcoin wallets you can download. For the purpose of this guide, we recommend Exodus. This desktop-based wallet is very beginner-friendly, starting from its polished design and intuitive user interface. Exodus stores your private keys offline on the device that you use the software on, meaning that even Exodus itself has no access to them. Your Exodus wallet is also designed to lock automatically after a stipulated period, requiring a password of your choosing to access. To further enhance your experience, the wallet’s lite model is designed such that you don’t have to download the entire blockchain. While this is commonly done to track past transactions, Exodus doesn’t make it mandatory.

Bitcoin Exchanges

Now that you’ve gotten your wallet in order, it’s time to start trading Bitcoin. To do that, you’ll need to find a viable crypto exchange where you can actually buy and sell the currency.

What Are Crypto Exchanges?

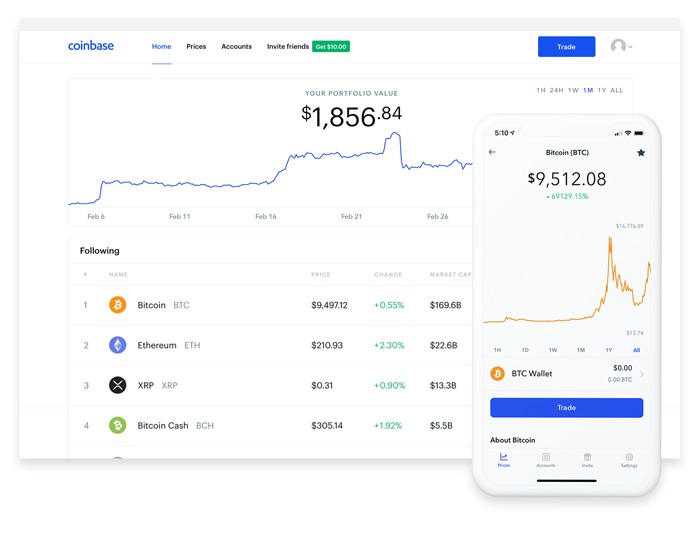

It’s not uncommon for crypto exchanges to be compared to wallets, and it’s not hard to figure out why: most exchanges like Coinbase come with their own in-built wallets. But apart from having a wallet function, crypto exchanges are the platforms where you actively buy and sell cryptocurrencies and convert regular money into cryptocurrency. Think of exchanges as all-in-one stops for all your cryptocurrency needs, letting you see your balance at a quick glance and trade cryptocurrency. Getting into an exchange isn’t particularly difficult, too: simply create an account, sign in, and voila, you’re ready to go. While crypto exchanges are fantastic for the convenience they give you, we still recommend that you maintain external wallets—especially cold ones—on the side. You never know when you might be the target of hackers, so having an offline failsafe will ensure the security of your Bitcoins. Check our guide on how to trade cryptocurrency for more in-depth information.

Best Crypto Exchange Platform

We’ve definitely spoken enough on crypto exchanges, so let’s now turn our eye to the best platform you can use to trade Bitcoins. In our books, Coinbase is the best platform available, and we’ll list down the reasons why. With a track record for being reliable, Coinbase is a crypto-to-fiat exchange that utilizes a strict token listing process to give you the best experience possible. To add to your experience, Coinbase has in place a simple user interface—sign up and start investing in the space of a few short minutes! This platform even pays you cryptocurrency when you hop onto its learning program to learn how cryptocurrency works. Bitcoin is a staple cryptocurrency of Coinbase, but so too are a bunch of others like Ethereum and Bitcoin Cash. You can be assured that the cryptocurrencies you see on the app are safe to invest in, as Coinbase adheres to a stringent vetting process to eliminate lower-quality ones. Coinbase also enjoys a high liquidity ranking. What this means is that investing in cryptocurrencies through this platform grants you protection from the negative consequences of major price drops in a market that is highly unstable by default. Not a fan of Coinbase or want to look at other options? Check out our guide on the best cryptocurrency exchanges.

Mining Bitcoin

Surprise, surprise. Buying on crypto exchanges isn’t the only way for you to acquire Bitcoins. You can also obtain them from scratch by mining them. Think of mining Bitcoins as the digital version of the California Gold Rush. But instead of mining gold, you’re digging for digital gold. In a nutshell, you mine Bitcoins by solving puzzles with the aid of powerful computer systems. There are two key ways to do so. One, you join a Bitcoin mining pool and attempt to mine it yourself. You can also buy or build a mining rig. For more details, check out our bitcoin mining guide.

Future of Bitcoin

Bitcoin Future Price

According to a press release published by FinancialNewsMedia.com, Bitcoin is projected to “quadruple in 2021 similar to the 2017 Parabolic Rally”. The 2017 Parabolic Rally refers to the parabolic setup that Bitcoin underwent that year, where the value first dipped before spiking. You can see this change in the chart below: In an interview with CNBC, Fundstrat’s Tom Lee predicts that “2021 is going to be a lot like 2017 which means Bitcoin should do even better in 2021 than it did in 2020, so something above 300%.” In essence, Bitcoin is expected to undergo a parabolic rally like it did in 2017.

Safely Invest in Bitcoin Today

Bitcoin has tremendous potential to help you earn massive passive income, but only provided that you know what you’re doing. Your journey with Bitcoin might have started with this guide, but it shouldn’t end here. Research, research, research. Familiarize yourself with the ins and outs of cryptocurrency, starting from the Ethereum vs Bitcoin comparison. Also, make sure that you keep yourself up to speed with every news update related to Bitcoin and other cryptocurrencies. If you have already purchased some coins, wait until they grow in price before selling them. With everything done and said, the rest is all up to you. Best of luck on your Bitcoin trading journey!